Swerve.Fi Newsletter #2

For the week ending October 4th, 2020

Welcome to the second edition of Swerve.fi Newsletter, discussing all things related to the Swerve ecosystem. Our aim with this newsletter is to keep the Swerve and crypto community informed of the latest news, including product launches, governance changes, and ecosystem updates.

Summary

Swerve Dashboard

Coingecko DeFi Listing

Total Value Locked

Audit

Treasury & Multisig Holders

Treasury Promissory Tokens (tSWRV)

Reduce Governance Quorum

sETH-ETH pools & Golden Liquidity Model

Tweet of the week

Swerve Dashboard

Over the weekend, one of our top community members @Chickenpie347 published the swerve dashboard, which in my honest opinion looks pretty slick. At the moment, it includes useful data such as the TVL, current price, volume, market cap, and more.

All of it is accessible at the following address, let’s get surfing:

Swerve on Coingecko’s top 100 DeFi list

After a push by the community lead by @simp2win on twitter, Swerve was successfully added to the DeFi list on Coingecko. Currently sitting at the 60th spot on the leaderboard Swerve has still a lot of room to grow.

You can view coingecko’s list here:

https://www.coingecko.com/en/defi

Total Value Locked (TVL)

On Thursday, Swerve Protocol created more money, then available on earth.

Too bad, it was simply an API problem which was quickly fixed by the team, here’s an explanation for the curious:

“It seems we rely on an API call to get all the balances locked into Swerve contract. The API call just basically returns all the stables and their balances. Now, these balances are added to get a total and displayed on the website.Somebody sent a token called "tomatos.finance" to the contract. And since the website is calculating all balances, it seems that's what's caused the issue.”

Some of you might have noticed that the TVL has been removed from the home page. After debating the subject, we have decided to remove the data from the homepage to keep it clean. You can now find the accurate TVL on the Swerve app and on the Swerve dashboard.

SIP-1 Audit

The highly anticipated audit was completed by Peckshield over the weekend. In summary no critical vulnerabilities were discovered. An interesting finding was that the on-chain oracle used for displaying the POOL APY in UI was off by a digit. POOL APY is ~10x what is was shown prior to sept 26th. Only the UI was affected.

You can see the full audit here:

The rest of the payment was transferred to Peckshield in two transactions of 8750 USDT and 8750 USDC.

Transaction hash: 0xe35cf6dabc1bc51f32705c490cac53728a62281b7d23811bfa31b203ac375703

0xf239ab1d4f07ece2b0ef15a4c6d13072d6cb0fc3200c1108fd8bb05a99f7826d

SIP-2 & SIP-9 Treasury & Multi-sig

The recent SIP-2 proposal to create Swerve treasury passed with flying colors on the second attempt. This now allows the Swerve protocol to generate an income. In short, we can now establish a precise budget based on our income. This budget is currently being built and we can expect a final draft in the upcoming days. Thank you everyone for rallying and exercising your Swivic duty.

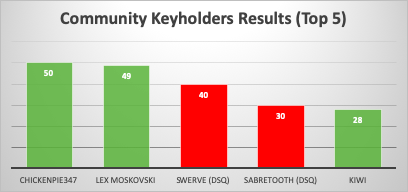

To summarize SIP-9, decided by SIP-9-T1 and SIP-9-T3, there would be a total of 7 multi-sig keyholders for the Treasury, out of which 3 would be from the community, and the remaining 4 external representatives not directly involved in the community.

Over the course of the week, we have elected all of our multi-sig keyholders. I am proud to announce that the trio for the community keyholders are Kiwi, Chickenpie347, and Lex Moskovski.

As part of SIP-9 T4 I am pleased to welcome our 4 outsider multi-sig holders in the Swerve family. The Swerve community has elected Framework Ventures, Sam Bankman-Fried from Alameda, Arthur0x from DeFiance Capital, and finally Mick Hagen from Genesis Block.

SIP-9 T4

https://snapshot.page/#/swerve/proposal/QmPYFCxzXVh5UEjqrktNHsoqDgXUvaw1Xa744Hf8K3CdX2

SIP-12 Treasury Promissory Tokens (tSWRV)

SIP-12 was recently passed on the snapshot vote. This proposal seeks to create a new token that serves as a promissory note from the treasury, isolated from the existing Swerve ecosystem, and that only interacts with the treasury.

1 tSWRV = 1 swUSD

tSWRVs will be issued to contributors and can also be issued to voters of proposals to offset gas-fees associated with voting, and even distribute rewards.

The idea is, each tSWRV can be redeemed for 1 swUSD from the future treasury, depending on the availability of funds in the treasury. This would help organise and bootstrap the current development/research/marketing and any other efforts deemed necessary by the community.

SIP-12 https://snapshot.page/#/swerve/proposal/QmQdnbhPcmnroFqXN5fpn7hqx9vWQCLvmft4FPR34GhJsP

SIP-11 Reduce Governance Quorum

SIP-11 was passed with the agreement to reduce the quorum to 3% on the snapshot page, but first to achieve this in a transparent way we need to jump through some hoops. We need 2 major 30% quorum votes.

1. To set the treasury address after the current proposal.

2. To reduce quorum to 3% as decided in snapshot vote.

On September 22, we could get 28% quorum if we got 100% participation from non-dead weight veSWRV. Of course, that's too optimistic, but when you factor in the drop that has happened on the 25th and the recent push for others to lock short term, it seems we have a very good chance of passing 30% quorum proposals. We should be able to improve these numbers further in the week to come.

SIP-11 https://snapshot.page/#/swerve/proposal/QmePBJC5Etxjh3vEzSuc1qrrBH65LBwbxzw96N5gd6snpB

SIP-13 sETH/wETH Pool, and the Golden Liquidity Pool Model

Market making for Pegged assets with low slippage are the cornerstone product offering of the SWRV ecosystem. Synthetix offers a no-slippage, chainlink oracle-based set of synthetic assets, with no-slippage trades between any asset pairs though their platform. The marriage of these two products has the potential to be an extremely significant driving force of the 3 most popular assets in the DeFi ecosystem, ETH, BTC, and USD.

We propose the creation of a 'Golden Liquidity Pool' which should rapidly become the most sought-after trading product on the Ethereum chain. By creating 3 low-fee low-slippage pools on Swerve, for each of ETH/BTC/USD, with all of them containing a synthetic asset (sETH/sBTC/sUSD), it would be possible to route trades ACROSS assets, using the Synthetix.Exchange platform to facilitate the inter-asset trades. On top of this, Synthetix has a Volume Incentive program, which will share 0.075% of all trades generated on their platform back to the referrer, further boosting our return on such trades.

SIP-13

https://snapshot.page/#/swerve/proposal/QmU4tAtVioz4anju4vFL6wpAQfsDVuV5KmL4Puu3JsSy4B

Tweet of the Week

FAQ

How does the Boost work?

Boost is a reward gaming mechanism where LPs can increase their rewards in proportion to other LPs who have not Boosted. It is more of a protection against dilution of rewards. If nobody boosts, everyone gets the base rate APY. If most users don't boost and some do, the boosters would get more rewards and the rewards for non-boosters would be reduced in proportion. If everyone boosts to max levels, everyone would get the base rate APY.

How does governance work?

Currently all the governance-related discussions take place in Discord. The proposals suggested by the community are put up for an off-chain voting solution on https://snapshot.page/#/swerve

Off-chain voting does not cost anything, and anyone is free to create proposals, although it is recommended to discuss it with the community first. Off-chain votes are used to gauge the readiness and acceptance of the community towards proposals, and the votes are made by using SWRV held in wallets. Off-chain proposals can be discussed in the numbered discussion channel in SIPS where the SIP number corresponds to the proposal.

Proposals that pass in the off-chain votes would be formalised on the official on-chain DAO which actually costs gas fees to vote and relies on Voting Power (veSWRV) instead of SWRV. Voting Power is attained by locking SWRV tokens in the DAO. The DAO proposals can be accessed at: https://bafybeiaudy7h3gh2355hbpc5rrmx6n5s6ttwxphfeuxbsa5dkqojqhnnsi.ipfs.dweb.link/dao/

All off-chain voting proposals that pass would eventually be put up for vote on DAO for finality and implementation.

- Still more questions?

You can find more information concerning frequently asked questions here on our official discord page, look for the #FAQ or the #support channel. https://discord.com/invite/vkhw8Av.

Do not forget that this is a community-built protocol. It is not often that you have the chance to get involved in promising blockchain projects, and this is one of those opportunities. “You can't sit back on the couch and then complain when dinner is served. Get on in the kitchen and help out!” Come and get involved in the discussion. Join us on our discord and telegram!

Swerve Protocol: https://swerve.fi/

Swerve DAO: http://ipfs2.swerve.fi/dao/#/dao/

Snapshot Voting: https://snapshot.page/#/swerve

Discord: https://discord.com/invite/vkhw8Av

Telegram: https://t.me/swervefi

Twitter: https://twitter.com/SwerveFinance

Community Forum: https://gov.swerve.community/

Created by RedArctic